lincoln ne sales tax increase

What is the sales tax rate in Lincoln Nebraska. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

View a list of national sales tax rate changes for other.

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15. The average cumulative sales tax rate in Lincoln Nebraska is 688. City and county governments will have to pick up the tab to meet community needs.

Lincoln voters approved the 14-cent increase in April to support two important public safety projects. In Lincoln the local sales and use tax rate will jump from 15 to 175. Delivery Spanish Fork Restaurants.

Within Lincoln there are around 28 zip codes with the most populous zip code being 68516. There is no applicable county tax or special tax. Opry Mills Breakfast Restaurants.

The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1. YORK The citys sales tax receipts for the month of February came to the highest total for a. A no vote was a vote against authorizing the.

Review Nebraska state city and county sales tax changes. Fix Lincoln Streets Now the coalition supporting the proposed quarter-cent sales tax increase has raised more than 200000 primarily from. The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. The Nebraska state sales and use tax rate is 55 055. Skip to main content.

The city took in 38965023 for the general. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements. 1 the Village of Orchard will start a 15 local sales and use tax.

The Nebraska state sales and use tax rate is 55 055. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. It was a close vote but.

800-742-7474 NE and IA. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. Lincoln Ne Sales Tax Rate 2018.

Lincoln NE 68509-4848 Phone. Restaurants In Matthews Nc That Deliver. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1.

You can print a 725 sales tax table here. Lincoln ne sales tax increase. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to.

Essex Ct Pizza Restaurants. The Lincoln sales tax rate is 175. Lincoln NE 68503 402 467-4321.

402-471-6031 Contact the Governors Office. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. Imposition of a sales tax will increase costs resulting in fewer animals being served.

926 P Street Lincoln NE. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. Soldier For Life Fort Campbell.

By 2021 the total will triple to 53 with the Lincoln Division accounting for just 217 of the bill total tax. The Nebraska state sales and use tax rate is 55 055. Nebraska sales tax rate change and sales tax rule tracker.

A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Replacement of the Citys emergency 911 radio system and the construction andor relocation of four. It was approved.

For tax rates in other cities see Nebraska sales taxes by city and county. Lincoln is located within Lancaster County Nebraska. Lincoln ne sales tax increase Monday March 21 2022 Edit.

As far as sales tax goes the zip code with the. On January 16 2019 AFP lifted Lincolns negative sales tax increase. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no.

The Nebraska sales tax rate is currently 55. This includes the sales tax rates on the state county city and special levels. 800-742-7474 NE and IA.

The local sales and use tax rate in Chadron will increase from 15 to 2. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio system and build four new.

More information for. There are no changes to local sales and. Lincoln NE 68509.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. Lincoln Ne Sales Tax Rate Mei 15 2021. Did South Dakota v.

The County sales tax rate is 0. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. For more information on sales tax visit the Nebraska website.

The local sales tax rate in Lincoln will increase to 175 from 15 the notice said and the village of Orchard will be subject to a new 15 sales tax rate. Elections Neighborhood streets are focus of. Income Tax Rate Indonesia.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725. This is the total of state county and city sales tax rates.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

What S The Car Sales Tax In Each State Find The Best Car Price

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

File Sales Tax By County Webp Wikimedia Commons

What S The Car Sales Tax In Each State Find The Best Car Price

States Are Imposing A Netflix And Spotify Tax To Raise Money

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 8 25 Free To Download And Print Tax Printables Sales Tax Tax

Nebraska Sales Tax Small Business Guide Truic

Charles Apple 신문 디자인 레이아웃 레이아웃 신문

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

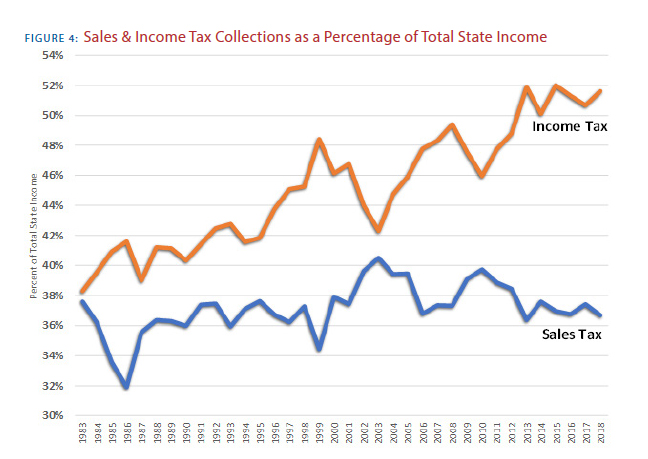

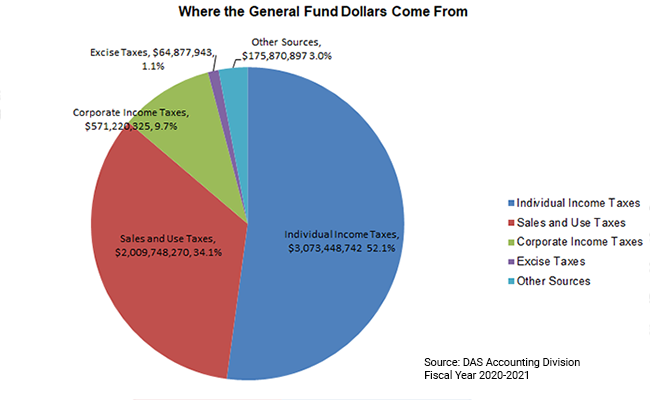

General Fund Receipts Nebraska Department Of Revenue

Nebraska Sales Tax Rates By City County 2022

How To Register For A Sales Tax Permit Taxjar

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase