massachusetts estate tax return due date

Web Massachusetts Estate Tax Return Rev. Ad Understand the different types of trusts and what that means for your investments.

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

This due date applies only if you have a valid extension of time to file the return.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Instructions on page 9 updated Form M-NRA Massachusetts. Web Form M-706 Massachusetts Estate Tax Return and Instructions Revised February 2021.

4 Gift Taxes Form 709. The Massachusetts estate tax. Massachusetts Department of Revenue PO Box 7023 Boston MA 02204.

The filing of the gift tax return occurs only if the decedent gave a gift of over 1500000 in. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. Web The estate tax return is due 9 months after the date of death.

Web For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. Web Deadlines for Filing the Massachusetts Estate Tax Return. Note that it is also possible to get a six-month extension of time to file these returns.

Here is the rate. Web Form M-4768 Massachusetts Estate Tax Extension of Time Request Payment Voucher Date of death mmddyyyy Tax type Voucher type ID type Vendor code. For estates of decedents dying in 2006 or after the applicable exclusion.

Note that the table below is. Select Popular Legal Forms Packages of Any Category. Web The due date for filing the estate tax returns is nine months from the decedents death.

Web 31 rows When to File Generally the estate tax return is due nine months after the date of death. Web Form 990 tax exempt organizations june 15 2022. Make check or money order payable to.

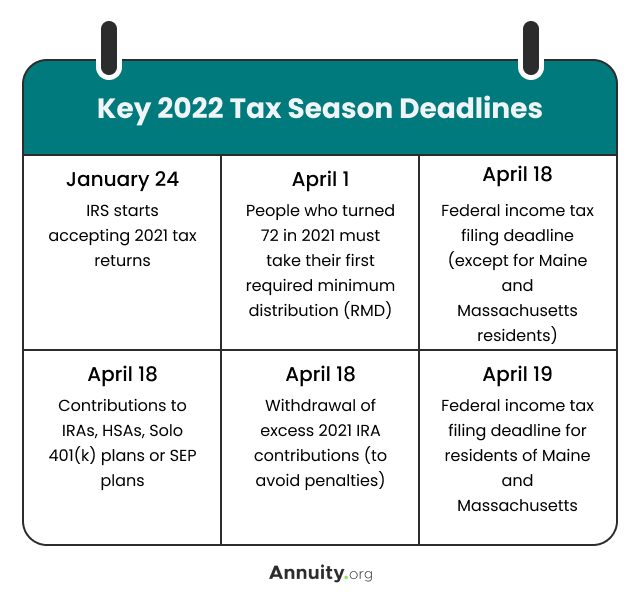

The tax filing deadline in 2022 is april 18 or april 19 if you live in maine or massachusetts. Web The Massachusetts estate tax law MGL. Web The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary.

Download Or Email M-706 More Fillable Forms Register and Subscribe Now. Well work closely with your tax advisor and attorney to prepare your investment plan. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Web A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. If youre responsible for the estate of someone who died you may need to file an. Web For deaths that occurred on or after January 1 2006 the executor of the estate must file a Massachusetts Estate Tax Return Form M-706 if the gross value of.

All Major Categories Covered. As of 2016 if the executor. Web Up to 25 cash back Deadlines for Filing the Massachusetts Estate Tax Return If a return is required its due nine months after the date of death.

1 018 Name of decedent Date of death mmddyyyy Social Security number 3 3 3 Street address at time of death. Web Download or print the 2021 Massachusetts Form M-4768 Massachusetts Estate Tax Extension Application for FREE from the Massachusetts Department of Revenue. A six month extension is available if requested prior to the due date and the.

April 18 2022 2nd payment. Web Signature Title Date File this return with payment in full.

A Guide To Estate Taxes Mass Gov

Tax Guide For Pass Through Entities Mass Gov

Massachusetts Estate Tax Everything You Need To Know Smartasset

A Guide To Estate Taxes Mass Gov

Massachusetts Income Tax H R Block

2022 Filing Taxes Guide Everything You Need To Know

Irs Announces Higher Estate And Gift Tax Limits For 2020

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Tax Deadline Extension What Is And Isn T Extended Smartasset

Prepare And E File Your 2021 2022 Ma Income Tax Return

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Massachusetts Estate And Gift Taxes Explained Wealth Management